How miniOrange DLP Enforces SEBI Compliance for Financial Institutions

The Securities and Exchange Board of India (SEBI) mandates a robust framework to protect investor data, ensure market integrity, and prevent insider trading. In today's digital ecosystem, sensitive financial data from client portfolios and trading algorithms to corporate financials and insider lists is constantly in motion across endpoints, emails, and cloud applications. Relying on manual policies and user awareness creates dangerous gaps in enforcement.

miniOrange Data Loss Prevention (DLP) transforms SEBI compliance from a static checklist into a dynamic, enforceable security posture. By automating the detection, monitoring, and prevention of data breaches, miniOrange DLP empowers brokerage firms, asset management companies, and depository participants to proactively meet SEBI's stringent data protection requirements.

Let’s explore how miniOrange DLP's comprehensive features align with and enforce key SEBI compliance pillars.

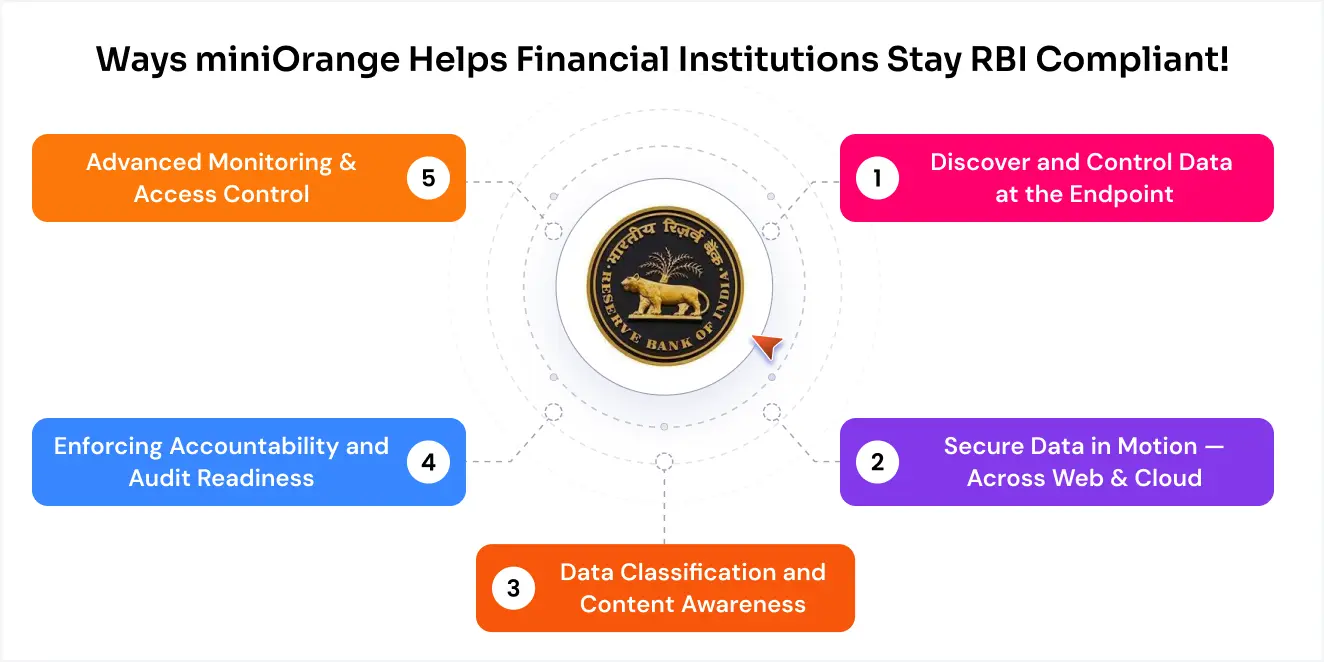

1. Lockdown Endpoints: Prevent Data Exfiltration at the Source

SEBI Focus: Secure access to sensitive financial systems and prevent unauthorized data copy/transfer, a critical measure against insider trading and data theft.

How miniOrange Enforces It:

- USB & Peripheral Control: Block all unauthorized USB storage devices. Allow only encrypted, company-issued drives for secure data transfer, ensuring client financial data or proprietary research cannot be copied to personal devices.

- Printer Control: Restrict printing of sensitive documents (e.g., draft financial statements, merger plans) to authorized printers only, preventing physical leaks.

- Application Control: Blacklist unauthorized software like personal cloud sync tools (e.g., unauthorized Dropbox), peer-to-peer sharing, and messaging apps that could be used to exfiltrate data.

Compliance Benefit: Enforces SEBI’s guidelines on secure access and controlled sharing of price-sensitive information.

2. Protect Data in Transit: Manage Online and Cloud Uploads

SEBI Focus: Monitor and secure all communication channels to prevent the leak of unreleased private information (UPSI) and client data.

How miniOrange Enforces It:

- Granular Website & Upload Policies:

- Block uploads of files containing sensitive patterns (Client ID, PAN, Demat Account numbers) to unauthorized websites.

- Restrict file uploads (e.g., .xlsx, .pdf, .csv) to only SEBI-approved or internal portals.

- Prevent access to personal webmail (Gmail, Yahoo) from corporate devices.

- Cloud Application Login Control: Allow logins only to approved company cloud accounts. Block access to personal Google Drive, Dropbox, or unapproved cloud storage.

Compliance Benefit: Actively stops the digital leak of UPSI and confidential client data through internet channels, a core SEBI mandate.

3. Data Classification & Content-Aware Protection

SEBI Focus: Identify and protect specific categories of sensitive information, especially UPSI and client personal data.

How miniOrange Enforces It:

- Advanced Classification Engine: Automatically detect SEBI-critical data such as:

- Client Data: PAN, Aadhaar, Demat Account Numbers, Client Codes.

- Corporate Data: Draft financial results, board meeting minutes, merger/acquisition plans.

- Trading Data: Large unpublished trade information, private trading code.

- Action Based on Content: Block, quarantine, or log files containing classified data when users attempt to transfer them via USB, email, or web upload.

Compliance Benefit: Provides smart, data-focused protection aligned with SEBI regulations.

4. Comprehensive Audit Trails & Forensic Readiness

SEBI Focus: Maintain detailed logs of system access and data movement for audits, investigations, and breach analysis.

How miniOrange Enforces It:

- Centralized Audit Dashboard: Real-time visibility into violations, high-risk incidents, and user activity.

- File Activity Logging: Track creation, modification, copy, deletion of sensitive files.

- Automated Alerts & Reporting: Instant notifications for policy breaches and compliance-ready reports.

Compliance Benefit: Simplifies SEBI inspections and internal audits with searchable, centralized logs.

5. Enhanced Monitoring & Access Governance

SEBI Focus: Ensure strict access controls, monitoring, and governance for privileged users.

How miniOrange Enforces It:

- Privileged Session Management: Enforce concurrency limits and inactivity logouts.

- Remote Lock & Wipe: Secure lost/stolen laptops containing sensitive data.

- Screen Monitoring (with disclosure): Capture periodic screenshots of high-risk user devices for investigation.

Compliance Benefit: Mitigates insider threats and strengthens SEBI’s cybersecurity posture.

A SEBI Compliance Scenario in Action

The Research Department of a Brokerage Firm:

- Analysts can access market data terminals and internal research portals.

- They cannot upload files containing "Q4 Results Draft" or "M&A Target Analysis" except to a whitelisted board portal.

- USB drives are fully blocked.

- Emails with client PAN data or proprietary datasets are quarantined for review.

- All activities in the

\Research\Unpublishedfolder are logged continuously.

miniOrange DLP ensures SEBI rules are automatically enforced at every data touchpoint.

Conclusion: From Mandate to Automated Enforcement

SEBI compliance can't be a slow process of checking documents after the fact. It requires proactive, smart enforcement.

miniOrange DLP provides the technological backbone to:

- Automatically prevent data breaches.

- Continuously monitor data flow across endpoints, web, and email.

- Enforce granular, context-aware policies aligned with SEBI’s protection goals.

Transform your SEBI compliance into a competitive advantage built on trust and security.

Contact miniOrange today at uemsupport@xecurify.com to schedule a personalized demo and see how our DLP solution helps your institution achieve continuous SEBI compliance.

Leave a Comment